How to calculate percentage in excel, how to calculate percentage growth, how to calculate gpa, how to calculate standard deviation, how to screenshot on windows 10, how to recall an email in outlook, how to use vlookup, how to screenshot on pc, how to delete a page in word, how to write a cover letter,

As you start to plan for a new car purchase, it's crucial to consider different financing options. One of the most popular ways to finance a vehicle is through a car loan. However, before you jump into signing a loan agreement, it's essential to understand how the math behind car loans works.

The Car Loan Equation Excel

Many people use Excel to calculate hypothetical loan payments when they're shopping for a new car. Excel is one of the best tools for creating equations that can predict things like payment amounts, loan balances, and interest rates.

The car loan equation in Excel is a simple calculation that takes the loan amount, the interest rate, and the loan term in years to calculate a monthly payment. You can also use this equation to calculate the total cost of the loan over time.

The formula you'll need to use is: PMT(RATE,NPER,PV,[FV],[TYPE]), where:

- RATE is the interest rate per year

- NPER is the total number of payments or the loan term in years

- PV is the amount borrowed or principal

- FV is optional and represents the future value or ending balance after the loan is paid off

- TYPE is optional and specifies when payments are due. A value of 0 means they are due at the end of the period (month), and a value of 1 means they are due at the beginning of the period (month).

For example, let's say you're financing a car for $20,000 with a 5-year loan term and a 4% interest rate. Using the car loan equation in Excel, the monthly payment would be $368.33. Over the life of the loan, you will have paid $22,099.80, with $2,099.80 in interest.

The Loan Payment Formula

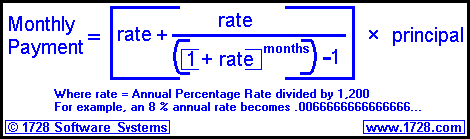

Another formula that you can utilize when calculating car loan payments and understanding the total cost of the loan is the loan payment formula. This formula considers the loan amount, the interest rate, and the loan term in months to calculate the monthly payment.

The formula is: Payment = (P x r)/(1 – (1+r)^(-n)), where:

- P is the loan amount

- r is the interest rate per period. To calculate the monthly interest rate, divide the annual rate by 12

- n is the total number of payments or the loan term in months

Using the same example as before, let's say you want to calculate the monthly payment using the loan payment formula. The loan amount is $20,000, the interest rate is 4% per year, and the loan term is 60 months. The monthly payment would be $368.33, again, similar to the result using the car loan equation in Excel.

It's important to note that these equations and formulas serve as guidelines. They can give you an estimate of what your monthly payment may be, but there are other factors that can affect your loan's final cost. Some of these factors include the loan provider, your credit score, and any fees or charges associated with the loan.

The Bottom Line

Financing a car is a significant decision that requires a lot of planning and consideration. By understanding how car loan payments work and using formulas like the car loan equation in Excel and the loan payment formula, you can better plan and budget for your next car purchase. Keep in mind that consulting a loan professional is always recommended before taking out a car loan.

Also read:

.Blog Archive

-

▼

2023

(57)

-

▼

May

(37)

- How To Convert Pdf To Word Without Losing Formatti...

- How To Set Setup Hotspot On Iphone 6 Plus

- How To Go Singapore By Train

- How To Use Eomonth Excel

- Galaxy S21 Cyber Monday Deals

- Hisense Tv Connect To Antenna

- How To Answer How Do You Handle Conflict At Work

- How To Find The Area Of The Triangle Abc

- How To Convert Pdf To Word Malayalam

- Thaumcraft 4 Axe Of The Stream

- How To Calculate Percentage Loan

- How Big Is The Hp Envy X360

- Cox Gigablast Download Speed

- Allegiant Plane Seating Chart

- Tv Tropes Psychic Powers

- Big Wet Squid Game

- Brittney Griner National Anthem Protest

- Samsung Galaxy S21 Ultra Cyber Monday

- Carta De Renuncia Colombiana

- Lifeboat Server Address Pc

- Ford Bronco Big Bend Review

- Jussie Smollett French Actor

- Rog Flow X13 Ultra Slim 2-in-1

- Brilliant Baking Change Game

- Dragon Ball Z Hulu Plus

- Thunderbolt Pushes Into Fast Alternative Usb

- Arris Surfboard Verizon Fios

- Lenovo Flex 11 11.6†2 In 1 Laptop

- Eid Ul Fitr 2019 In Pakistan

- Cox Contour Stream Player

- Lg G Watch Urbane Second Edition

- All Caps On Chromebook

- Instapot Air Fryer Wings

- Minecraft Parody Dont Mine At Night

- 4k Over The Air Broadcast

- When Does Phantump Evolve

- Rival Rebels Mod 1122 Download

-

▼

May

(37)

Total Pageviews

Search This Blog

Popular Posts

-

Tv tropes psychic force, tv tropes psychic static, tv tropes psychic powers, tvtropes org, tv tropes nightmare fuel, rwby tv tropes, tv trop...

-

How to convert pdf to word without losing formatting free, how to convert pdf to word without losing formatting free, how to convert pdf to ...

-

Thaumcraft 4 axe of regrowth, thaumcraft 4 axe of peace, thaumcraft 4 axe of godrick, thaumcraft 4 axe of purity, thaumcraft 4 axe of the dw...